銀行におけるブロックチェーンアプリケーション

インダストリー4.0では、「ブロックチェーン」はデジタル変革と将来のITプラットフォームの構築のための「主要」テクノロジーと見なされている。データ情報をリアルタイムで透過的に共有し、ストレージスペースを節約し、高いセキュリティを実現する機能を備えたブロックチェーンテクノロジーは、幅広い適用性を備えた画期的なテクノロジートレンドの1つである。 多くの産業や分野で広く使用されている。 この記事では、ブロックチェーン、銀行業界でのいくつかの適用事例、および近い将来の課題と推奨事項を紹介する。

2020年06月25日

インダストリー4.0では、「ブロックチェーン」はデジタル変革と将来のITプラットフォームの構築のための「主要」テクノロジーと見なされている。データ情報をリアルタイムで透過的に共有し、ストレージスペースを節約し、高いセキュリティを実現する機能を備えたブロックチェーンテクノロジーは、幅広い適用性を備えた画期的なテクノロジートレンドの1つである。 多くの産業や分野で広く使用されている。 この記事では、ブロックチェーン、銀行業界でのいくつかの適用事例、および近い将来の課題と推奨事項を紹介する。

インダストリー4.0では、「ブロックチェーン」はデジタル変革と将来のITプラットフォームの構築のための「主要」テクノロジーと見なされている。

データ情報をリアルタイムで透過的に共有し、ストレージスペースを節約し、高いセキュリティを実現する機能を備えたブロックチェーンテクノロジーは、幅広い適用性を備えた画期的なテクノロジートレンドの1つである。 多くの産業や分野で広く使用されている。 この記事では、ブロックチェーン、銀行業界でのいくつかの適用事例、および近い将来の課題と推奨事項を紹介する。

ブロックチェーンとは?

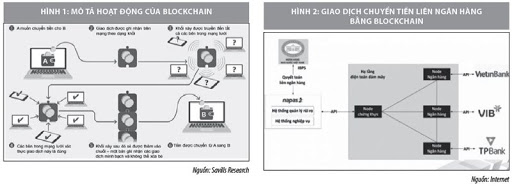

ブロックチェーンは、会社の元帳に似た非常に複雑な暗号化システムに基づいてデータを安全に送信できるようにするテクノロジーで、現金が厳密に監視される。 この場合、ブロックチェーンはデジタル分野で活動する台帳である。 ブロックチェーンには、情報を確認するための仲介者を必要とせずにデータを送信する特別な機能がある。

ブロックチェーンシステムには、「信念のサイン」を必要とせずに情報を認証できる多くの独立したノードがある。 ブロックチェーン内の情報は変更できず、システム内のすべてのノードの同意を得てのみ追加される。 これは、データの盗難の可能性に対する高度なセキュリティシステムである。 ブロックチェーンシステムの一部が崩壊しても、他のコンピューターとノードは情報を保護し続け、ネットワークを稼働させ続ける。

ブロックチェーン技術の興味深い点は、安全で高速かつ低コストのオプションを提供することである。 たとえば、実現可能性を保証するためにデポジットを必要とする取引の場合、プログラムは両方の当事者が100 USDを送信するブロックチェーンで実行され、このプログラムは両方の当事者の200 USDを安全に保つ。

最終的な結果が複数のデータソースに基づくと、このテクノロジーは自動的に全額を勝者に転送する。 各当事者は論理契約を確認でき、ブロックチェーンプラットフォームで実行されているため、変更したり停止したりすることはできない。

銀行部門の場合、このテクノロジーが銀行とその顧客の両方にもたらす効果を視覚化するのは簡単である。

銀行業界におけるブロックチェーンの応用と挑戦。

銀行業界でのブロックチェーン応用能力。

コンサルティング会社のアクセンチュアによる調査によると、現在、トップマネージャーの半数以上が、ブロックチェーンが銀行や金融会社の成功に重要な役割を果たすことを認めている。 アナリストはまた、世界中の銀行がブロックチェーン技術を採用することにより、2022年までに200億ドルを節約できると強調している。 一部の金融アナリストは、遠くない将来、ブロックチェーンが既存の銀行振込システムに取って代わると信じている。

ブロックチェーンが銀行にもたらすもう1つのアプリケーションは、分散型台帳識別システムである。 すべての銀行と金融機関がKYC(Know Your Customer)認証プロセスを持っている必要があるため、これは本当に効果的である。 ブロックチェーンを使用すると、ユーザーは簡単な手順で身元を確認でき、この情報はシステム内の他の銀行に保存および承認される。 金融および銀行業務は、預金およびローンのセキュリティに直接関連している。 しかし、今日の世界最大の銀行の一部では、保証は依然として不確かである。

ただし、ブロックチェーンテクノロジーを適用すると、預金と領収書の配布システム全体が分散化され、個人や組織によって制御されなくなる。 または保険支払いプロセスと同じくらい簡単である。 従来の運用方法の代わりに、保険支払いプロセスは自動的に行われる。 システムはスマート契約、自動検証で動作し、当事者間の遅延はなく、支払いプロセスはすぐに行われる。

銀行業界の状況と挑戦にブロックチェーンを展開する際。

現在、世界におけるブロックチェーンアプリケーションの応用状況。

ポーランド銀行協会のオンライン信用処理機関Bureauは、顧客データを処理するブロックチェーンソリューションを作成することにより、約1億5000万人のヨーロッパ人の信用履歴を記録している。 スペイン最大の銀行グループであるBanco Santanderは、ブロックチェーンテクノロジーの運用への応用を開拓し、ブロックチェーンプラットフォームにOne Pay FX支払いシステムを構築した。

このシステムの主な目的は、分散型台帳を使用してヨーロッパと南アメリカ間の支払いを最適化することである。 JPMorganはブロックチェーンの未来を非常に信頼しており、このテクノロジーを研究および適用するビジネスを立ち上げた。 現在、銀行は金融活動のアプリケーションをテストしている。

中国の銀行業界の情報筋によると、CEBNetのサイトによると、中国の26の銀行のうち12が年間のプロファイルで、2017年に意図された用途にブロックチェーンアプリケーションを使用したことを明らかにしました。2018年5月15日、HSBCは、完全にブロックチェーン技術プラットフォームに実装された信用状を介した最初の商業金融取引を正常に実装したことを発表した。

Reuters(2018年9月28日)によると、カナダ王立銀行(RBC)は、米国とカナダの支店間の支払いにブロックチェーンの使用をテストしている。 ブロックチェーン技術は現在、RBCのメインシステムと並行して実行されているため、銀行は米国とカナダ間の支払いをリアルタイムで追跡できる。

ブロックチェーンは、スピードアップ、複雑さの軽減、支払いコストの削減に役立つ。 RBC Bankは、以前はトロントにあるセンターで、ブロックチェーンHyperledgerを専門とするオープンソース組織が提供するソフトウェアを使用して、ブロックチェーンシステムを開発した。

以前、CNBCは、IBMがヨーロッパ最大の7つの銀行(Deutsche Bank、HSBC、KBC、Natixis、Rabobank、Societe Generale、Unicreditを含む)だけにブロックチェーン技術を構築していると報告した。 中小企業の国際貿易の効率を高める。 Wells FargoとCommonwealth Bank of Australiaは昨年、ブロックチェーンを使用して、米国から中国への綿花の輸出と加工も行った。

2018年、メルセデスベンツブランドを所有するドイツの自動車会社であるダイムラーは、ランデスバンクバーデンヴュルテンベルク(LBBW)と協力して、1億ユーロ相当の金融取引にブロックチェーンを使用した。 ダイムラーの発表によると、同社は社債を発行して、LBBWと他の3つの銀行から通常の法の手続きと並行してブロックチェーンを使用して資金を借り入れた。

ブロックチェーンは、契約の締結および実施から、返済および利息の支払いの確認まで、プロセス全体を自動化する。 これにより、複数の契約の作成、投資家との交換、支払い、および貸し手も必要とせずに、今日いくつかの手動ステップを実行するための人件費が節約されて、 複雑な管理および制御メカニズムを適用する必要がある。

ベトナムでは2018年7月、NAPASは3つの銀行VietinBank、VIB、およびTPBankと協力し、4週間の実装後にブロックチェーンを使用した銀行間送金トランザクションのテストに成功した(図3を参照)。 これは、このテクノロジーが徐々に普及してきており、銀行がその傾向から外れていないことを示している。

挑戦になるは?

多くの利点と前向きな提案があるが、この新しいトレンドには確かに挑戦がある。

2016年のデロイトのエグゼクティブサーベイによると、米国のトップエグゼクティブの39%は、ブロックチェーンについての知識がほとんどまたはまったくない。 彼らは知識の欠如に加えて、典型的な標準や学ぶべきブロックチェーンプロジェクトも欠いている。 銀行は、ブロックチェーンテクノロジーの広範な採用を促進するために、統一された標準とプロトコルをよりよく理解および開発するために、より連携する必要がある。

ブロックチェーン採用率に関するもう1つの懸念は、法的および法的不確実性である。 イーサリアムブロックチェーンによって導入されたスマートコントラクトは銀行のコスト削減に役立つが、その有効性は多くの国でまだ認識されている。 現在、ブロックチェーンプロトコルの監視と規制を担当する標準または組織は世界中にない。 組織は、国際的に受け入れられている規制を策定する時間を必要とする。

ハーバードビジネスレビューによると、ブロックチェーンは「画期的なテクノロジーではなく、基本的なテクノロジーであり、私たちの経済および社会システムの新しい基盤を作成する可能性を秘めている」。 銀行がブロックチェーンを適用する場合、ブロックチェーンの幅広い採用において、銀行はスケーラビリティ、トランザクション速度、検証プロセス、およびデータ制限にも挑戦する必要がある。

結論

ブロックチェーン技術は、銀行や金融の分野で本当に大きな可能性を開いている。それは、取引確認、現金管理、資産最適化、およびプロセスのプロセスに大きな影響を与える。 他のビジネス。 ブロックチェーン技術は、登録からトランザクションの完了までの時間を短縮したり、銀行間トランザクション、国際送金、または個人情報の確認にかかる時間を短縮したりするのに役立つ。 これまでのところ、ブロックチェーンは「銀行業界のための非現実的なアイデア」という概念を完全に超えている。 このテクノロジーはこれまでも、そして今後も多くの銀行やその他の生活分野で成功を収めていくでしょう。

テクノロジーの専門家によると、テクノロジーの進歩により、人間の生活は変化し、ブロックチェーンも例外ではない。 ブロックチェーンの範囲は暗号通貨に限定されず、完全に未知の人々がサードパーティの認証を必要とせずにトランザクションを実行できるようにする人間の活動の交換全体である。 ブロックチェーンテクノロジーがどのように実現するかについて楽観的になりすぎたり心配しすぎたりしないでください。このテクノロジーをインテリジェントに理解して適用する方法は、世界を良い方向に変える鍵である。

ベトナムでアウトソーシングを展開するオフショアパートナーをお探しの場合は、ベトナムに長年在籍している企業以外にも、ハチネットは以下の特徴を体験できる場所です。

Microsoft .NET Webサイト開発(asp、vb.net ...)

ウェブサイト開発フォント終了

Javaシステム/アプリケーション開発

モバイルアプリケーション開発(IOS / Android)。

Cobolシステム開発。

私たちにもサービスがあります

柔軟なオフショア開発

BrSE担当者を日本に派遣

現在、Hachinetのパートナーの80%は日本のソフトウェア企業であり、当社のエンジニアは、高い技術を持つだけでなく、お客様と日本語で直接にコミュニケーションをとることができる。

Hachinetは、常にソフトウェアの品質と顧客の満足度を重視している。当社のITアウトソーシングサービスを選択すれば、製品が実装されてから納品されるまで安心できると信じる。

メールでご連絡ください:contact@hachinet.com

- オフショア開発

- エンジニア人材派遣

- ラボ開発

- ソフトウェアテスト

電話番号: (+84)2462 900 388

メール: contact@hachinet.com

お電話でのご相談/お申し込み等、お気軽にご連絡くださいませ。

無料見積もりはこちらから